When it comes to buying a home in San Diego, there’s one decision that’s just as important as choosing the house itself—choosing the right mortgage broker. Whether you’re a first-time buyer in San Diego or a seasoned homeowner, finding someone you can trust to guide you through the lending process is absolutely critical.

As someone who’s helped hundreds of families here in San Diego, I can tell you: who you work with makes all the difference.

My name is Trevor Sanders, and I’m the owner of SD-Loans. I take great pride in helping clients get into the homes they love—with confidence, clarity, and competitive rates. In this post, I’ll walk you through the key things to look for when choosing a mortgage broker in San Diego—and what sets SD-Loans apart from the rest.

Why Your Choice of Mortgage Broker Matters

The mortgage process isn’t just about locking in a rate. It’s about:

- Understanding your options

- Avoiding costly mistakes

- Navigating complicated paperwork

- And most importantly—feeling supported from start to finish

Related post: Broker or Direct Lender: Which One Saves You More in the Long Run?

In a high-cost market like San Diego, your mortgage broker should do more than just get you a loan—they should be your advocate, guide, and problem-solver throughout the journey.

What Exactly Does a Mortgage Broker Do?

A mortgage broker acts as the middleman between you and lenders, helping you:

- Compare different loan products

- Find the best interest rates

- Understand terms and conditions

- Submit your application

- Navigate underwriting

- Get to the finish line: funding and keys in hand

At SD-Loans, we work with a wide range of lenders, which means we’re not tied to a single bank’s offerings. Instead, we shop around on your behalf to make sure you’re getting the best possible loan for your financial situation and goals.

Related post: Tired of Big Bank Red Tape? Here’s Why a Mortgage Broker Is the Answer

What to Look for in a San Diego Mortgage Broker

Not all mortgage brokers are created equal. Here are the key qualities I recommend every homebuyer consider before choosing a broker to work with:

1. Local Expertise Matters

San Diego is a unique market. From Point Loma to La Mesa, Chula Vista to Oceanside, each neighborhood comes with its own pricing trends, property types, and financing challenges. You want someone who knows the local market inside and out.

At SD-Loans, we’ve been helping San Diego homebuyers navigate this dynamic market for years. I’ve worked with military families using VA loans, retirees looking to downsize in Del Cerro, and first-time buyers venturing into North Park condos. Every situation is different, and local experience gives us an edge in providing smart, relevant guidance.

2. Look for Transparency and Honesty

The right broker will clearly explain your loan options, fees, rates, and timelines—and won’t pressure you into something that doesn’t fit. You should always feel informed, not confused.

I make it a personal mission to demystify the lending process. I break down every step so you know what’s happening and why. No jargon. No surprises. Just clear communication and thoughtful support.

3. Ask About Access to Lenders and Loan Programs

A strong broker has access to a wide network of lenders, including those offering:

- Conventional home loans

- FHA loans

- VA loans

- Jumbo loans

- Non-QM and self-employed options

- First-time homebuyer assistance programs

Because I’m not tied to one lender, I can help you explore a full spectrum of financing options. My goal is always to find the program that benefits YOU the most—not the lender.

Related post: Top 5 Benefits of Working with a Mortgage Broker in San Diego

4. Responsiveness and Personalized Service

Buying a home often happens on tight timelines. You need a broker who’s responsive, available, and adaptable to your schedule and needs.

At SD-Loans, I offer one-on-one consultations via phone, Zoom, or in-person—whatever works for you. I’m not a call center. When you call me, you’re getting me, not a chatbot or junior processor. That personal connection allows us to move faster, smoother, and more confidently together.

5. Digital Tools That Make Life Easier

While personal service is essential, technology helps streamline the process. Look for brokers who offer secure online applications, digital document uploads, and e-signatures.

We’ve made the process incredibly simple and secure at SD-Loans. Our clients love our easy online mortgage application which saves time and eliminates the hassle of printing, scanning, and mailing forms.

The SD-Loans Difference

When you work with me, you’re not just getting a loan—you’re getting a partner. Here’s what I promise every client:

- Tailored mortgage strategy based on your life goals

- Ongoing communication—I keep you updated every step of the way

- Access to the best rates and programs through a vast network of lenders

- Fast and smooth closings to help you stay competitive in San Diego’s market

- Support after the loan closes, whether you’re refinancing, upgrading, or buying again

(Note: Create a refinancing-specific page to support this anchor.)

I believe that homeownership should be empowering—not stressful. That’s why I take the time to educate and support my clients every step of the way.

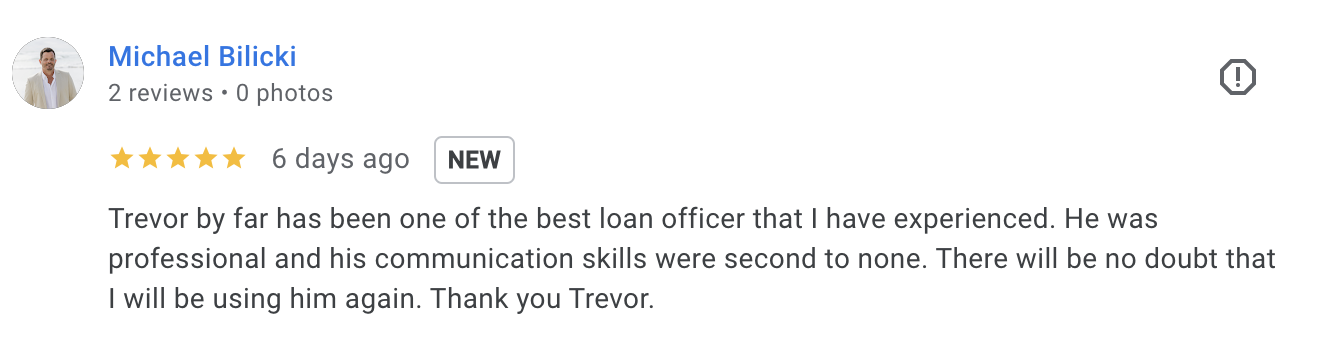

What My Clients Say

“Trevor made the whole process feel seamless. I was a first-time buyer and nervous, but he explained every step and helped us close in under 30 days.” – Maria G., San Diego

“We were relocating from out of state, and Trevor worked late hours and weekends to help us. His team was always professional, fast, and reliable.” – Sean P., Navy Veteran

Client success is my motivation—and it’s why so much of my business comes from referrals and repeat clients.

How to Get Started with a Mortgage Broker

If you’re just starting your journey, here’s how we can connect:

✅ Step 1: Schedule an Intro Call

We’ll go over your goals, questions, and budget.

✅ Step 2: Complete the Online Application

Simple, secure, and mobile-friendly.

✅ Step 3: Get Pre-Approved

We’ll determine your price range and issue a pre-approval letter to strengthen your offer.

✅ Step 4: Find Your Home

Work with your realtor and shop with confidence.

✅ Step 5: Close the Deal

We handle the paperwork and funding—so you get the keys, stress-free.

Final Thoughts: Choose a Broker Who Treats You Like Family

This is more than a transaction—it’s your future home. You deserve to work with someone who treats it with the same care, attention, and integrity they’d give their own family.

If you’re looking for a mortgage broker in San Diego who’s knowledgeable, local, and truly on your side, I’d be honored to help you. Let’s build your path to homeownership together—step by step.

📞 Call/Text: 619-855-5061

Keys In Hand, New Chapter Unlocked