If you’re buying a new construction home in San Diego, chances are the builder is nudging you toward their “preferred lender.” Maybe they’re offering an incentive—like a credit toward closing costs or a shiny upgrade package. Sounds tempting, right?

But before you sign on the dotted line, let me—Trevor Sanders, mortgage broker and owner of SD-Loans—give you the full picture. Because while using the builder’s lender might be the best choice, it’s not always the smartest one. And as your advocate, I want to make sure you’re informed, empowered, and getting the deal that truly benefits you, not just the builder.

Related post: Top 5 Benefits of Working with a Mortgage Broker in San Diego

🏗️ Why Builders Push Their Preferred Lenders

Let’s start with the obvious—builders want control. By encouraging you to use their in-house or affiliated lender, they:

- Speed up the transaction

- Limit delays from outside parties

- Sometimes make a little extra on the financing side

They’ll often sweeten the pot with things like:

- $5,000–$20,000 in closing cost credits

- Free upgrades (flooring, appliances, etc.)

- Lower interest rates for a limited time

And hey, sometimes those perks are legit! But not always…

🔍 What You Might Be Giving Up

When you only use the builder’s lender, you’re putting all your eggs in one basket. You’re not shopping around. You’re not comparing rates or fees. And in some cases, you’re signing on to a deal that favors the builder more than it favors you.

Here’s what to watch for:

- Higher long-term rates (introductory rates may spike later)

- Higher origination or processing fees buried in fine print

- Limited loan options—especially if you don’t fit a cookie-cutter profile

- Pressure to waive appraisal contingencies or other protections

That $10K in upgrades? You could be paying double that over the life of the loan without even realizing it.

Related Post: Why a Local Mortgage Broker Cares More About Your Home Loan Than a Big Bank Ever Will

💼 What a Mortgage Broker (Like Me) Brings to the Table

This is where I step in. As a local San Diego mortgage broker, I work for you, not the builder, not the bank.

Here’s what you get when you work with SD-Loans:

- Access to multiple lenders with competitive rates and flexible terms

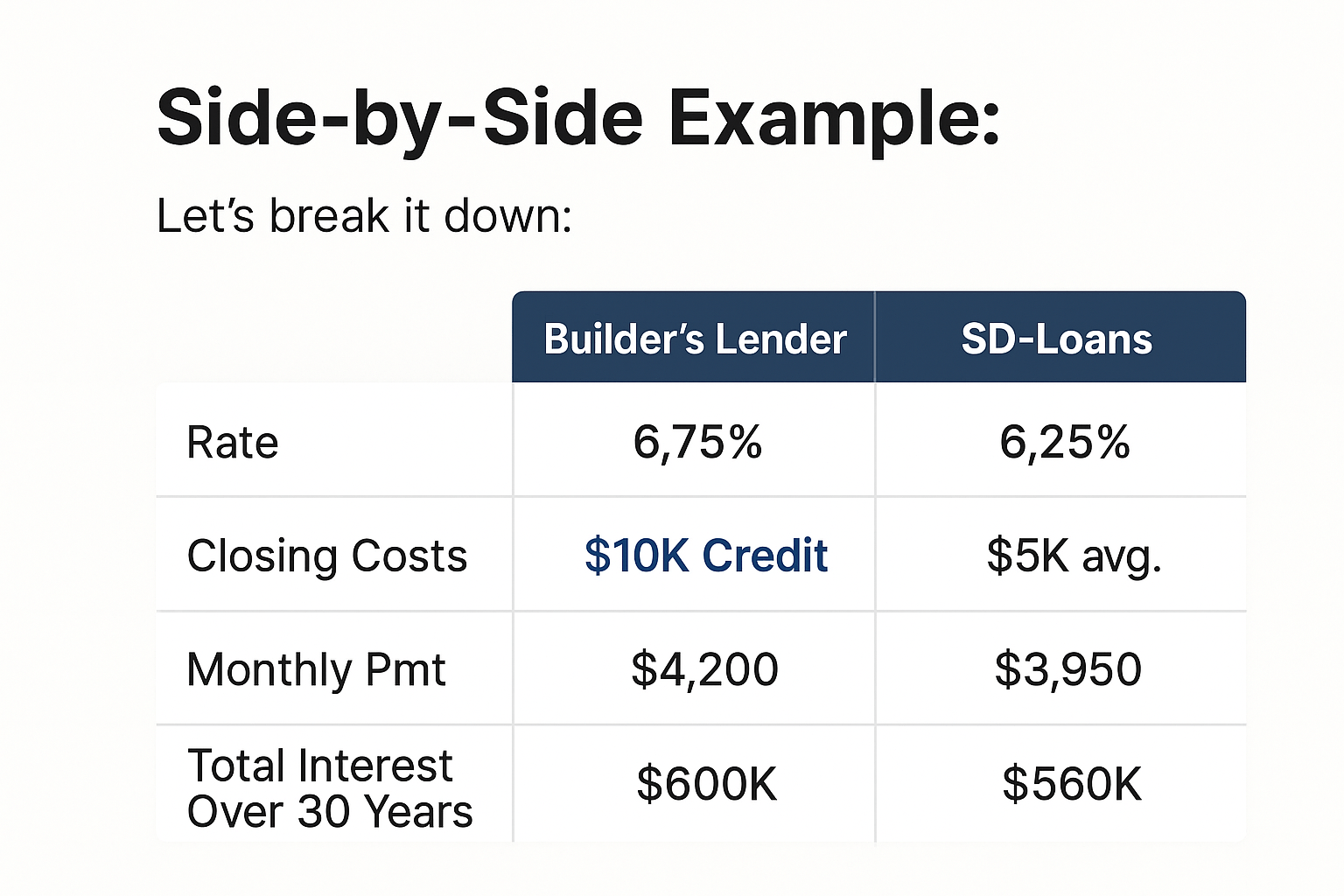

- Side-by-side comparisons of builder offers vs. market options

- No pressure to choose one loan product—we customize it to you

- Help understanding the fine print so nothing sneaks up on you

I’ve helped San Diego buyers get better rates and save thousands—even when the builder’s offer looked good on paper.

Sure, that credit sounds nice, but when you look long-term, the savings from a lower rate and better terms can outweigh any up-front perks.

💡 When It Might Make Sense to Use the Builder’s Lender

I’ll be straight with you: there are times when the builder’s lender actually is the best choice. If they’re offering a killer deal, and I’ve compared it and can’t beat it—I’ll tell you.

What matters most is that you made the decision with full transparency and actual options, not because you felt pressured.

💬 My Promise as Your Mortgage Advocate

When you work with me, you get:

- A transparent breakdown of every loan offer

- An honest opinion on what’s best for your financial future

- A partner who’s got your back—even if we don’t close a loan together

I care about more than closing deals. I care about making sure San Diego buyers—especially first-time and new construction buyers—aren’t taken advantage of by slick incentives or one-size-fits-all loans.

🛠️ Tips for San Diego New Construction Buyers

1. Always Compare Offers

Don’t sign with the first lender you talk to—bring the builder’s offer to me and I’ll break it down for you.

2. Don’t Skip Pre-Approval

Get pre-approved with a mortgage broker first. That way, you’ll know what you qualify for before the builder starts pushing their numbers.

3. Read the Fine Print

Ask about prepayment penalties, ARM terms, balloon payments, and any rate adjustment clauses.

4. Ask Questions

Don’t be afraid to say, “Why does this rate seem higher?” or “Can I compare this with another lender?” That’s your right as a buyer.

❓ FAQs

Q1: Are builders allowed to require that I use their lender?

No. It’s illegal for builders to require a specific lender—but they can offer incentives that are only valid if you use their preferred lender.

Q2: Can I still get the builder’s incentives if I use my own lender?

Sometimes, yes. Other times, no. Let’s look at the math and see if the incentives are actually worth it.

Q3: Do builder lenders offer better rates?

Not always. Often their rates are higher, but they offset it with flashy credits or “teaser” rates that adjust later.

Q4: Will working with a broker slow down the process?

Nope. In fact, I often close faster than builder lenders because I work with lenders who specialize in quick approvals.

Q5: How do I get started with SD-Loans?

Visit sd-loans.com, email me at [email protected], or call me at 619-855-5061. I’ll walk you through your options, no pressure.

🧠 Final Thoughts from Trevor Sanders

🧠 Final Thoughts from Trevor Sanders

Buying new construction in San Diego can be exciting—but it can also be tricky if you don’t have someone in your corner. A builder’s preferred lender isn’t automatically the wrong choice—but it’s not automatically the best either.

You deserve to know your options. That’s what I do here at SD-Loans: help you navigate the mortgage process with clarity, confidence, and choice.

So if you’re considering a new build or just want to compare rates with a real human who’s got your back, reach out. Let’s talk numbers—and make sure they work in your favor. Text me at SD-Loans to create your custom plan: 619-855-5061.

Keys In Hand, New Chapter Unlocked 🔑