Hey there, I’m Trevor Sanders, owner of SD-Loans and your home loan broker here in San Diego. I’m excited to guide you through one of the most critical yet often overlooked aspects of home financing—your credit score.

If you’re thinking about buying a home here in beautiful San Diego, you’ll need a clear understanding of how credit scores can significantly impact your financing terms. At SD-Loans, we believe in empowering our clients with practical strategies tailored to individual needs, making the journey to homeownership as smooth and advantageous as possible.

Unlock lower mortgage rates in San Diego.

Call Trevor for credit help: 619-855-5061

Understanding the Importance of Credit Scores in San Diego

Why Credit Scores Matter in Home Financing

Think of your credit score as your financial reputation. It’s the first thing lenders look at to gauge how reliable you are as a borrower. A higher score means better loan options, lower interest rates, and potentially thousands of dollars saved over the life of your mortgage. But what specifically makes San Diego unique?

Unique Considerations for the San Diego Market

San Diego’s housing market is competitive and often pricey. Lenders here are particularly cautious because home prices are high. This means having a strong credit score is even more important. It could be the deciding factor between securing your dream home or missing out.

How Credit Scores Impact Your Mortgage Terms

Interest Rates and Credit Scores

When it comes to home loans, even a slight change in your interest rate can make a significant difference. For example, a borrower with excellent credit might secure an interest rate of 5%, while someone with fair credit could get around 6.5%. Over a 30-year loan, that 1.5% difference can easily cost tens of thousands of dollars.

Loan Amounts and Approval Chances

Your credit score directly affects how much money a lender is willing to offer. Lower scores can limit your maximum loan amount or even lead to application denial, narrowing your home-buying options significantly.

Ready for better San Diego home loan terms?

Call Trevor: 619-855-5061

Factors That Influence Your Credit Score

Payment History

This is the single biggest factor—making up about 35% of your score. Paying bills late can dramatically reduce your score, making timely payments critical.

Amounts Owed (Credit Utilization)

Credit utilization accounts for about 30% of your score. Aim to keep your balances below 30% of your available credit. Lower utilization signals responsibility to lenders.

Length of Credit History

The longer you’ve managed credit, the better lenders understand your financial habits. This factor comprises roughly 15% of your credit score.

Types of Credit

Lenders like seeing a mix of credit types (auto loans, credit cards, mortgages), as it indicates experience handling different financial responsibilities.

New Credit Applications

Each time you apply for credit, your score can take a temporary hit. Frequent applications suggest financial distress or instability.

Strategies to Improve Your Credit Score

Pay Your Bills on Time, Every Time

Nothing boosts your score faster or more consistently than paying bills promptly. Set automatic payments to avoid missed due dates.

Lower Your Credit Utilization Ratio

Reduce your balances or increase your credit limits to keep your credit utilization low—ideally below 30%.

Limit New Credit Applications

Be strategic about applying for new credit. If you’re planning to buy a home soon, hold off on other significant financial commitments.

Regularly Monitor Your Credit Report

Checking your credit report regularly helps catch errors early, giving you time to correct them before they negatively affect your home loan application.

Related post: Why a Local Mortgage Broker Cares More About Your Home Loan Than a Big Bank Ever Will

Common Credit Score Mistakes Homebuyers Make

Closing Old Credit Cards

Closing accounts might seem smart, but it reduces your total available credit and can shorten your credit history—two factors that can hurt your score.

Ignoring Minor Debts

Even small debts can damage your credit report. Take care of any outstanding balances, no matter how minor.

Making Major Purchases Before Loan Approval

Hold off on buying that new car or furniture set until after your mortgage closes to avoid impacting your credit negatively.

How Long Does It Take to Improve Your Credit Score?

Improving credit takes patience. Generally, you’ll notice changes in about three to six months. Substantial improvements may take longer, so planning ahead is crucial.

San Diego home loans? Get local expert advice.

Call Trevor: 619-855-5061

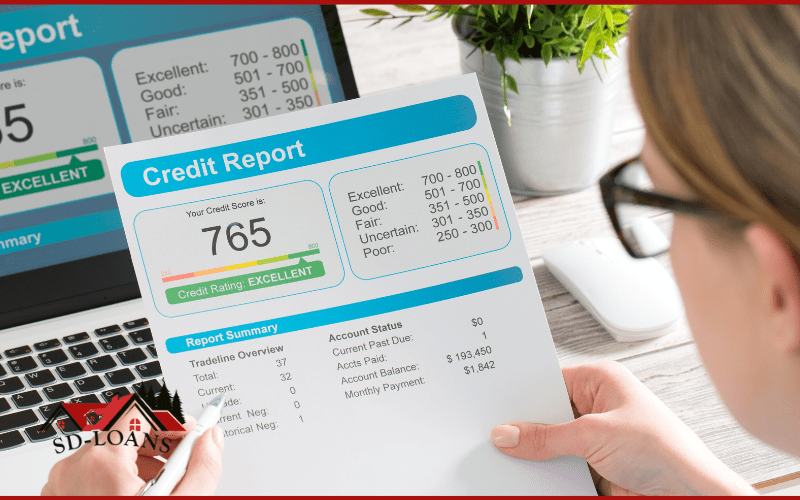

Credit Score Ranges and What They Mean for Homebuyers in San Diego

Excellent Credit (750+)

Access to the lowest interest rates and highest loan approvals.

Good Credit (700-749)

Generally favorable rates and terms.

Fair Credit (650-699)

Higher interest rates and stricter loan requirements, though still possible to obtain financing.

Poor Credit (Below 650)

Limited loan options and high interest rates; improving your score first is advisable.

San Diego home finance questions?

Speak to Trevor: 619-855-5061

Leveraging Credit Counseling for Better Home Loan Outcomes

Professional credit counseling services can provide personalized strategies to enhance your credit profile, greatly improving your chances of securing favorable mortgage terms.

Why Work with a Local Mortgage Broker Like SD-Loans?

Choosing a local expert like our team at SD-Loans means you’ll receive tailored advice specific to San Diego’s unique housing market. We’re committed to helping you navigate credit challenges and achieve homeownership goals.

Take Control: Boost Your Credit, Unlock Your San Diego Home Future.

Improving your credit score isn’t just a numbers game—it’s about taking control of your financial future. By understanding how your credit score affects home financing in San Diego and applying targeted strategies, you’re paving the way for better mortgage terms and savings down the road.

Ready to start your journey?

Reach out today, and let’s make homeownership a reality together.

Contact Trevor Sanders at 619-855-5061